Essay

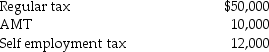

Beth and Jay project the following taxes for the current year:

How much in estimated tax payments (including withholding from wages and quarterly estimated payments)should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

How much in estimated tax payments (including withholding from wages and quarterly estimated payments)should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

a. Preceding tax year-AGI of $140,000 and total taxes of $36,000.

b. Preceding tax year-AGI of $155,000 and total taxes of $50,000.

Correct Answer:

Verified

a. The taxpayers should pay i...

a. The taxpayers should pay i...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q25: In the fall of 2014,James went back

Q34: All of the following statements regarding self-employment

Q42: The nonrefundable disabled access credit is available

Q50: An individual with AGI equal to or

Q57: Medical expenses in excess of 10% of

Q89: A taxpayer will be ineligible for the

Q98: In computing the alternative minimum taxable income,no

Q115: In 2014 Charlton and Cindy have alternative

Q122: Refundable tax credits<br>A)only offset a taxpayer's tax

Q665: Assume you plan to volunteer at a