Multiple Choice

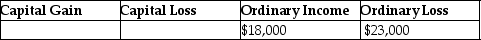

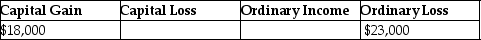

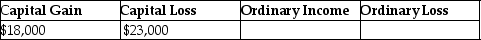

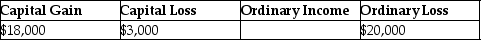

Jeremy has $18,000 of Section 1231 gains and $23,000 of Section 1231 losses. The gains and losses are characterized as

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q24: Emma owns a small building ($120,000 basis

Q35: With regard to noncorporate taxpayers,all of the

Q49: Octet Corporation placed a small storage building

Q63: Which of the following assets is 1231

Q82: Sec.1245 ordinary income recapture can apply to

Q88: An unincorporated business sold two warehouses during

Q91: During the current year,George recognizes a $30,000

Q94: Costs of tangible personal business property which

Q101: Harry owns equipment ($50,000 basis and $38,000

Q1719: What is the purpose of Sec. 1245