Essay

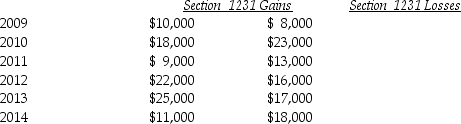

Lucy, a noncorporate taxpayer, experienced the following Section 1231 gains and losses during the years 2009 through 2014. Her first disposition of a Sec. 1231 asset occurred in 2009. Assuming Lucy had no capital gains and losses during that time period, what is the tax treatment in each of the years listed?

Correct Answer:

Verified

Correct Answer:

Verified

Q12: When gain is recognized on an involuntary

Q28: With respect to residential rental property<br>A)80% or

Q36: During the current year,Kayla recognizes a $40,000

Q57: In 1980,Mr.Lyle purchased a factory building to

Q63: Which of the following assets is 1231

Q70: For noncorporate taxpayers,depreciation recapture is not required

Q71: Clarise bought a building three years ago

Q100: For livestock to be considered Section 1231

Q113: During the current year,Danika recognizes a $30,000

Q1719: What is the purpose of Sec. 1245