Essay

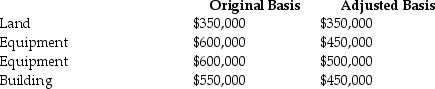

Describe the tax treatment for a noncorporate taxpayer in the 39.6% marginal tax bracket who sells each of the first two assets for $500,000 and each of the second two assets for $750,000. Each asset was purchased in 2010 and is used in a trade or business. There are no other gains and losses and no nonrecaptured Section 1231 losses.

Correct Answer:

Verified

• Land: $150,000 Section 1231 gain taxed...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q48: Gifts of appreciated depreciable property may trigger

Q55: In addition to the normal recapture rules

Q79: Section 1231 property will generally have all

Q79: The amount recaptured as ordinary income under

Q81: For a business,Sec.1231 property does not include<br>A)timber,coal,or

Q83: Dinah owned land with a FMV of

Q84: When a donee disposes of appreciated gift

Q93: Sec.1245 applies to gains on the sale

Q97: Why did Congress establish favorable treatment for

Q1297: Sarah owned land with a FMV of