Multiple Choice

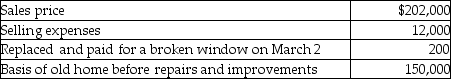

Frank, a single person age 52, sold his home this year. He had lived in the house for 10 years. He signed a contract on March 4 to sell his home and closed the sale on May 3. Based on these facts, what is the amount of his recognized gain?

Based on these facts, what is the amount of his recognized gain?

A) $0

B) $39,800

C) $40,000

D) $52,000

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Where non-like-kind property other than cash is

Q27: Whitney exchanges timberland held as an investment

Q48: Kai owns an apartment building held for

Q51: Glen owns a building that is used

Q56: For purposes of nontaxable exchanges,cash and non-like-kind

Q72: Which of the following is not an

Q89: Kevin exchanges an office building used in

Q92: In an involuntary conversion,the basis of replacement

Q95: If there is a like-kind exchange of

Q924: The basis of non- like- kind property