Multiple Choice

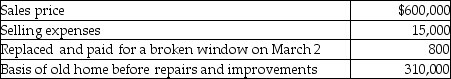

Pierce, a single person age 60, sold his home this year. He had lived in the house for 10 years. He signed a contract on March 4 to sell his home.  Based on these facts, what is the amount of his recognized gain?

Based on these facts, what is the amount of his recognized gain?

A) $0

B) $25,000

C) $40,000

D) $275,000

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q23: If a principal residence is sold before

Q45: Marinda exchanges an office building worth $800,000

Q51: In order for the gain on the

Q55: A taxpayer may elect to defer recognition

Q56: For purposes of nontaxable exchanges,cash and non-like-kind

Q67: Eric exchanges a printing press with an

Q91: Luke's offshore drilling rig with a $700,000

Q94: Alex owns an office building which the

Q99: Vector Inc.'s office building burns down on

Q115: Summer exchanges an office building used in