Multiple Choice

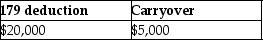

Cate purchases and places in service property costing $150,000 in 2014. She wants to elect the maximum Sec. 179 deduction allowed. Her business income is $20,000. What is the amount of her allowable Sec. 179 deduction and carryover, if any?

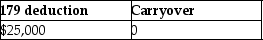

A)

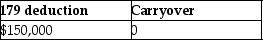

B)

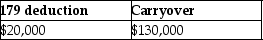

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Under the MACRS system,the same convention that

Q11: Under the MACRS system,depreciation rates for real

Q24: Once the business use of listed property

Q24: Why would a taxpayer elect to capitalize

Q34: On January l Grace leases and places

Q34: Sec.179 tax benefits are recaptured if at

Q35: Capital improvements to real property must be

Q45: Any Section 179 deduction that is not

Q54: Amounts paid in connection with the acquisition

Q90: Everest Corp. acquires a machine (seven-year property)on