Multiple Choice

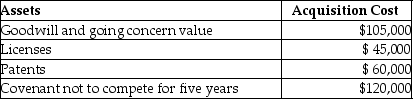

On January 1, 2014, Charlie Corporation acquires all of the net assets of Rocky Corporation for $2,000,000. The following intangible assets are included in the purchase agreement:  What is the total amount of amortization allowed in 2014?

What is the total amount of amortization allowed in 2014?

A) $15,000

B) $22,000

C) $31,000

D) $38,000

Correct Answer:

Verified

Correct Answer:

Verified

Q4: On January 3,2011,John acquired and placed into

Q18: Intangible assets are subject to MACRS depreciation.

Q22: For real property placed in service after

Q25: When a taxpayer leases an automobile for

Q26: In order for an asset to be

Q34: J.R.acquires an oil and gas property interest

Q40: Under the MACRS rules,salvage value is not

Q47: Taxpayers are entitled to a depletion deduction

Q58: If the business use of listed property

Q90: In August 2014,Tianshu acquires and places into