Essay

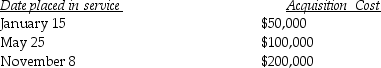

Mehmet, a calendar-year taxpayer, acquires 5-year tangible personal property in 2014 and does not use Sec. 179. Mehmet places the property in service on the following schedule:

What is the total depreciation for 2012?

What is the total depreciation for 2012?

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Joan bought a business machine for $15,000

Q11: On May 1,2008,Empire Properties Corp.,a calendar year

Q14: If a company acquires goodwill in connection

Q23: Lincoln purchases nonresidential real property costing $300,000

Q32: Residential rental property is defined as property

Q43: Tessa owns an unincorporated manufacturing business.In 2014,she

Q49: In January of 2014,Brett purchased a Porsche

Q50: Under the MACRS system,automobiles and computers are

Q61: The election to use ADS is made

Q83: If personal-use property is converted to trade