Essay

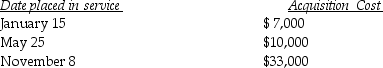

Greta, a calendar-year taxpayer, acquires 5-year tangible personal property in 2014 and places the property in service on the following schedule:

Greta elects to expense the maximum under Section 179, and selects the property placed into service on November 8. Her business 's taxable income before section 179 is $190,000. What is the total cost recovery deduction (depreciation and Sec. 179)for 2014?

Greta elects to expense the maximum under Section 179, and selects the property placed into service on November 8. Her business 's taxable income before section 179 is $190,000. What is the total cost recovery deduction (depreciation and Sec. 179)for 2014?

Correct Answer:

Verified

Because Sec. 179 expensing is...

Because Sec. 179 expensing is...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q18: This year Bauer Corporation incurs the following

Q20: MACRS recovery property includes tangible personal and

Q23: Most taxpayers elect to expense R&E expenditures

Q41: Costs that qualify as research and experimental

Q49: In calculating depletion of natural resources each

Q59: Unless an election is made to expense

Q70: Intangible drilling and development costs (IDCs)may be

Q80: The basis of an asset must be

Q84: On April 12,2013,Suzanne bought a computer for

Q86: Terra Corporation,a calendar-year taxpayer,purchases and places into