Essay

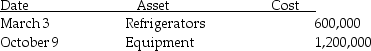

During the year 2014, a calendar year taxpayer, Marvelous Munchies, a chain of specialty food shops, purchased equipment as follows:

Assume the property is all 5-year property. What is the maximum depreciation that may be deducted for the assets this year, 2014, assuming the alternative depreciation system is not chosen?

Assume the property is all 5-year property. What is the maximum depreciation that may be deducted for the assets this year, 2014, assuming the alternative depreciation system is not chosen?

Correct Answer:

Verified

The mid-quarter convention mus...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: In May 2014,Cassie acquired a machine for

Q12: All of the following are true with

Q13: On its tax return,a corporation will use

Q25: On May 1,2012,Empire Properties Corp.,a calendar year

Q35: On October 2,2014,Dave acquired and placed into

Q37: In computing MACRS depreciation in the year

Q45: Under the MACRS system,if the aggregate basis

Q59: Eric is a self-employed consultant.In May of

Q63: On June 30,2014,Temika purchased office furniture (7-year

Q86: In July of 2014,Pat acquired a new