Essay

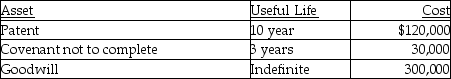

Stellar Corporation purchased all of the assets of Bellavia Company as of January 1 this year for $1 million. Included in the assets acquired are the following intangible assets:

What is Stellar's maximum amortization deduction for the year?

What is Stellar's maximum amortization deduction for the year?

Correct Answer:

Verified

The assets are Sec. 197 acquis...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: In May 2014,Cassie acquired a machine for

Q13: On its tax return,a corporation will use

Q14: If the business usage of listed property

Q25: On May 1,2012,Empire Properties Corp.,a calendar year

Q26: Under MACRS,tangible personal property used in trade

Q31: The mid-quarter convention applies to personal and

Q67: Prithi acquired and placed in service $190,000

Q86: In July of 2014,Pat acquired a new

Q527: Discuss the options available regarding treatment of

Q1256: Why would a taxpayer elect to use