Essay

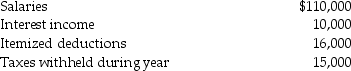

Brad and Angie had the following income and deductions during 2014:

Calculate Brad and Angie's tax liability due or refund, assuming that they have 2 personal exemptions. They file a joint tax return.

Calculate Brad and Angie's tax liability due or refund, assuming that they have 2 personal exemptions. They file a joint tax return.

Correct Answer:

Verified

$110,000 + 10,000 - $16,000 - ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q54: Which of the following is not an

Q75: Adam Smith's canons of taxation are equity,certainty,convenience,and

Q79: Charlotte pays $16,000 in tax deductible property

Q81: If a taxpayer's total tax liability is

Q82: Helen,who is single,is considering purchasing a residence

Q90: During the current tax year,Charlie Corporation generated

Q95: Peyton has adjusted gross income of $20,000,000

Q103: An individual will be subject to gift

Q104: Anne,who is single,has taxable income for the

Q938: What does the statute of limitations mean?