Essay

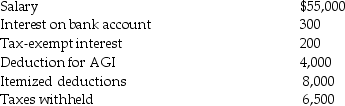

Chris, a single taxpayer, had the following income and deductions during 2014:

Calculate Chris's tax liability due or refund for 2014.

Calculate Chris's tax liability due or refund for 2014.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: A tax bill introduced in the House

Q26: Which of the following taxes is progressive?<br>A)sales

Q46: In an S corporation,shareholders<br>A)are taxed on their

Q47: Latashia reports $100,000 of gross income on

Q48: A proportional tax rate is one where

Q50: When returns are processed,they are scored to

Q58: Vincent makes the following gifts during 2014:<br>$15,000

Q83: Denzel earns $130,000 in 2014 through his

Q89: Which of the following taxes is proportional?<br>A)gift

Q335: Describe the types of audits that the