Multiple Choice

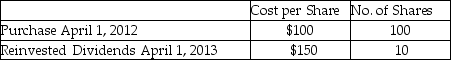

Rachel holds 110 shares of Argon Mutual Fund. She is planning to sell 90 shares. Her record of the share purchases is noted below. What could be her basis for the 90 shares to be sold for purposes of determining gain?

A) $9,000

B) $9,500

C) $9,409

D) Any of the above could be used as basis for the 90 shares sold.

Correct Answer:

Verified

Correct Answer:

Verified

Q28: Antonio is single and has taxable income

Q29: Amanda,whose tax rate is 33%,has NSTCL of

Q34: Everest Inc.is a corporation in the 35%

Q45: During the current year,Don's aunt Natalie gave

Q55: Interest incurred during the development and manufacture

Q80: Jade is a single taxpayer in the

Q80: Kathleen received land as a gift from

Q105: The gain or loss on an asset

Q106: Rana purchases a 5%,$100,000 corporate bond at

Q115: Gain on sale of a patent by