Essay

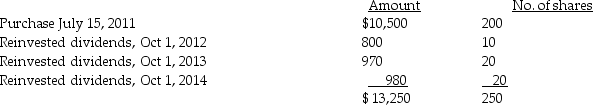

Joy purchased 200 shares of HiLo Mutual Fund on July 15, 2011, for $10,500, and has been reinvesting dividends. On December 15, 2015, she sells 100 shares.  What is the basis for the shares sold assuming (1) FIFO and (2) average cost method?

What is the basis for the shares sold assuming (1) FIFO and (2) average cost method?

Correct Answer:

Verified

Assuming FIFO, the basis in th...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q14: Sari is single and has taxable income

Q29: Which one of the following is a

Q39: Rick sells stock of Ty Corporation,which has

Q70: Kate subdivides land held as an investment

Q91: Generally,gains resulting from the sale of collectibles

Q94: Jessica owned 200 shares of OK Corporation

Q103: If the taxpayer's net long-term capital losses

Q106: Courtney sells a cottage at the lake

Q132: Darla sold an antique clock in 2015

Q2205: What are arguments for and against preferential