Multiple Choice

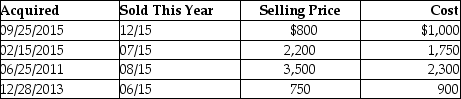

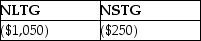

This year, Lauren sold several shares of stock held for investment. The following is a summary of her capital transactions for 2015:  What are the amounts of Lauren's capital gains (losses) for this year?

What are the amounts of Lauren's capital gains (losses) for this year?

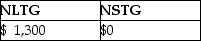

A)

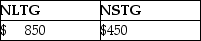

B)

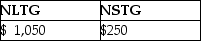

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q35: Niral is single and provides you with

Q36: On January 31 of this year,Mallory pays

Q36: In the current year, ABC Corporation had

Q42: Brad owns 100 shares of AAA Corporation

Q64: Unlike an individual taxpayer,the corporate taxpayer does

Q69: A nonbusiness bad debt is deductible only

Q77: In a basket purchase,the total cost is

Q81: Jordan paid $30,000 for equipment two years

Q90: Capitalization of interest is required if debt

Q130: In the current year,Andrew received a gift