Multiple Choice

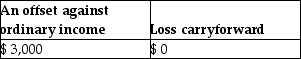

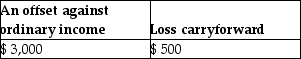

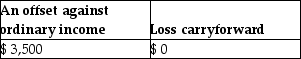

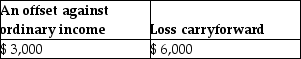

Gertie has a NSTCL of $9,000 and a NLTCG of $5,500 during the current taxable year. After gains and losses are offset, Gertie reports

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q9: Which one of the following does not

Q16: Taxpayers who own mutual funds recognize their

Q20: Billy and Sue are married and live

Q41: The initial adjusted basis of property depends

Q44: Losses are generally deductible if incurred in

Q92: Dale gave property with a basis of

Q95: In 2006,Regina purchased a home in Las

Q113: Purchase of a bond at a significant

Q122: With regard to taxable gifts after 1976,no

Q124: Expenditures which do not add to the