Multiple Choice

Rita, who has marginal tax rate of 39.6%, is planning to make a gift to her grandson who is in the lowest tax bracket. Which of the following holdings of stock would be the most tax advantageous gift from Rita's perspective?

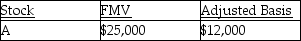

A)

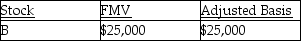

B)

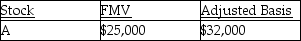

C)

D) For income tax purposes, Rita will be indifferent as to choice of stock to gift.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Kendrick, who has a 33% marginal tax

Q10: For purposes of calculating depreciation,property converted from

Q54: If the stock received as a nontaxable

Q72: When a taxpayer has NSTCL and NLTCG,the

Q77: Rita died on January 1,2015 owning an

Q87: Michelle purchased her home for $150,000,and subsequently

Q99: In a community property state,jointly owned property

Q105: If a capital asset held for one

Q107: Adam purchased 1,000 shares of Airco Inc.common

Q135: Corporate taxpayers may offset capital losses only