Essay

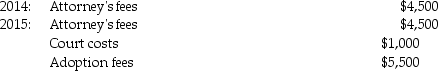

Tyler and Molly, who are married filing jointly with $210,000 of AGI in 2015, incurred the following expenses in their efforts to adopt a child:  The adoption was finalized in 2015. What is the amount of the allowable adoption credit in 2015?

The adoption was finalized in 2015. What is the amount of the allowable adoption credit in 2015?

Correct Answer:

Verified

Qualifying expense:  Less upper income p...

Less upper income p...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: A self-employed individual has earnings from his

Q28: Jake and Christina are married and file

Q51: Harley's tentative minimum tax is computed by

Q68: Discuss when Form 6251,Alternative Minimum Tax,must be

Q76: Evan and Barbara incurred qualified adoption expenses

Q83: If an individual is classified as an

Q88: Max and Alexandra are married and incur

Q99: In the fall of 2015,Gina went back

Q200: Describe the differences between the American Opportunity

Q2031: Discuss the tax planning techniques available to