Essay

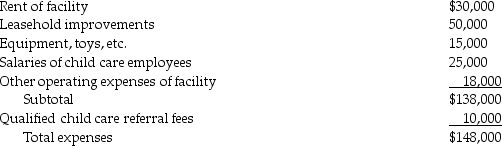

Hawaii, Inc., began a child care facility for its employees during the year. The corporation incurred the following expenses:  What is the amount of Hawaii's credit for employer-provided child care?

What is the amount of Hawaii's credit for employer-provided child care?

Correct Answer:

Verified

The credit is ($138,000 × .25)...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: Self-employed individuals are subject to the self-employment

Q18: The alternative minimum tax applies to individuals,corporations,estates,and

Q24: Jeffery and Cassie,who are married with modified

Q28: Which one of the following is a

Q47: Self-employment taxes include components for<br>A)Medicare hospital insurance

Q63: For purposes of the AMT,only the foreign

Q99: Casualty and theft losses in excess of

Q110: Research expenses eligible for the research credit

Q111: Kerry is single and has AGI of

Q126: Which of the following statements is incorrect