Essay

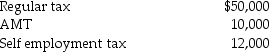

Beth and Jay project the following taxes for the current year:  How much in estimated tax payments (including withholding from wages and quarterly estimated payments) should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

How much in estimated tax payments (including withholding from wages and quarterly estimated payments) should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

a. Preceding tax year-AGI of $140,000 and total taxes of $36,000.

b. Preceding tax year-AGI of $155,000 and total taxes of $50,000.

Correct Answer:

Verified

a. The taxpayers should pay i...

a. The taxpayers should pay i...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q42: The nonrefundable disabled access credit is available

Q49: Timothy and Alice,who are married with modified

Q55: In computing AMTI,tax preference items are<br>A)excluded.<br>B)added only.<br>C)subtracted

Q59: A taxpayer at risk for AMT should

Q61: All tax-exempt bond interest income is classified

Q62: If an individual is an employee and

Q66: All of the following statements are true

Q93: Joe,who is single with modified AGI of

Q118: When a husband and wife file a

Q130: In computing AMTI,adjustments are<br>A)limited.<br>B)added only.<br>C)subtracted only.<br>D)either added