Multiple Choice

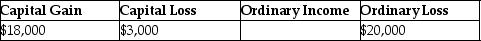

Jeremy has $18,000 of Section 1231 gains and $23,000 of Section 1231 losses. The gains and losses are characterized as

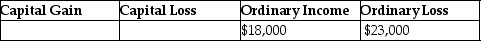

A)

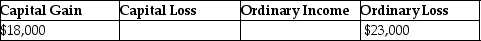

B)

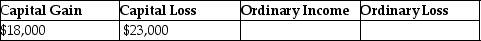

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q20: The additional recapture under Sec.291 is 25%

Q21: If Section 1231 applies to the sale

Q26: Terry has sold equipment used in her

Q28: With respect to residential rental property<br>A)80% or

Q35: With regard to noncorporate taxpayers,all of the

Q36: During the current year,Kayla recognizes a $40,000

Q84: On June 1,2012,Buffalo Corporation purchased and placed

Q86: Jed sells an office building during the

Q93: Sec.1245 applies to gains on the sale

Q108: Depreciable property used in a trade or