Essay

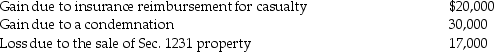

The following are gains and losses recognized in 2015 on Ann's business assets that were held for more than one year. The assets qualify as Sec. 1231 property.  A summary of Ann's net Sec. 1231 gains and losses for the previous five-year period is as follows:

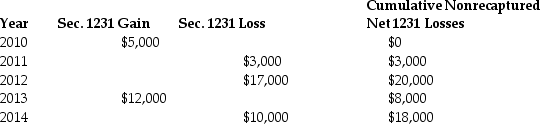

A summary of Ann's net Sec. 1231 gains and losses for the previous five-year period is as follows:  Describe the specific tax treatment of each of the current year transactions.

Describe the specific tax treatment of each of the current year transactions.

Correct Answer:

Verified

The $20,000 gain from the casualty is tr...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q26: Terry has sold equipment used in her

Q32: Any gain or loss resulting from the

Q35: Network Corporation purchased $200,000 of five-year equipment

Q36: During the current year,Kayla recognizes a $40,000

Q37: During the current year,Hugo sells equipment for

Q40: During the current year,a corporation sells equipment

Q55: Sec.1250 requires a portion of gain realized

Q66: Section 1250 does not apply to assets

Q82: Sec.1245 ordinary income recapture can apply to

Q113: During the current year,Danika recognizes a $30,000