Essay

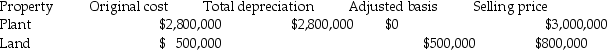

Julie sells her manufacturing plant and land originally purchased in 1980. Accelerated depreciation had been taken on the building, but the building is now fully depreciated. Julie is in the 39.6% marginal tax bracket. Other information is as follows:  She has not sold any other assets this year. A review of her file indicates that the only asset dispositions in the past five years was a truck sold for a $10,000 loss last year. What are the tax consequences of the sale (type of gain; rates at which taxed)?

She has not sold any other assets this year. A review of her file indicates that the only asset dispositions in the past five years was a truck sold for a $10,000 loss last year. What are the tax consequences of the sale (type of gain; rates at which taxed)?

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Section 1245 recapture applies to all the

Q6: A corporation owns many acres of timber,which

Q7: All of the following are considered related

Q12: Pam owns a building used in her

Q22: An unincorporated business sold two warehouses during

Q23: Blair,whose tax rate is 28%,sells one tract

Q86: Pierce has a $16,000 Section 1231 loss,a

Q91: Indicate whether each of the following assets

Q94: Costs of tangible personal business property which

Q97: Why did Congress establish favorable treatment for