Multiple Choice

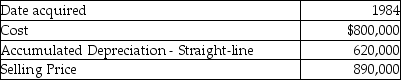

A corporation sold a warehouse during the current year. The straight-line depreciation method was used. Information about the building is presented below:  How much gain should the corporation report as section 1231 gain?

How much gain should the corporation report as section 1231 gain?

A) $124,000

B) $620,000

C) $586,000

D) $710,000

Correct Answer:

Verified

Correct Answer:

Verified

Q4: A corporation owns many acres of timber,which

Q20: The additional recapture under Sec.291 is 25%

Q28: With respect to residential rental property<br>A)80% or

Q35: With regard to noncorporate taxpayers,all of the

Q37: Eric purchased a building in 2005 that

Q46: Describe the tax treatment for a noncorporate

Q79: Section 1231 property will generally have all

Q84: On June 1,2012,Buffalo Corporation purchased and placed

Q93: Sec.1245 applies to gains on the sale

Q100: For livestock to be considered Section 1231