Multiple Choice

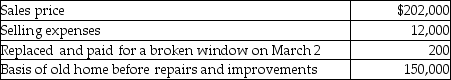

Frank, a single person age 52, sold his home this year. He had lived in the house for 10 years. He signed a contract on March 4 to sell his home and closed the sale on May 3.  Based on these facts, what is the amount of his recognized gain?

Based on these facts, what is the amount of his recognized gain?

A) $0

B) $39,800

C) $40,000

D) $52,000

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Bobbie exchanges business equipment (adjusted basis $160,000)for

Q14: Indicate with a "yes" or a "no"

Q27: On May 1 of this year,Ingrid sold

Q28: The exchange of a partnership interest for

Q51: Glen owns a building that is used

Q54: Which of the following statements regarding involuntary

Q66: An investor exchanges an office building located

Q76: Which of the following statements is not

Q84: All of the following statements are true

Q93: Sometimes taxpayers should structure a transaction to