Essay

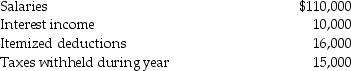

Brad and Angie had the following income and deductions during 2015:  Calculate Brad and Angie's tax liability due or refund, assuming that they have 2 personal exemptions. They file a joint tax return.

Calculate Brad and Angie's tax liability due or refund, assuming that they have 2 personal exemptions. They file a joint tax return.

Correct Answer:

Verified

Tax = $10,312.50 + .25(96,000...

Tax = $10,312.50 + .25(96,000...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: AB Partnership earns $500,000 in the current

Q18: Arthur pays tax of $5,000 on taxable

Q55: The primary liability for payment of the

Q57: Limited liability companies may elect to be

Q58: Vincent makes the following gifts during 2015:<br>$15,000

Q62: When a change in the tax law

Q71: Regressive tax rates decrease as the tax

Q75: Adam Smith's canons of taxation are equity,certainty,convenience,and

Q80: All states impose a state income tax

Q98: In 2015,an estate is not taxable unless