Multiple Choice

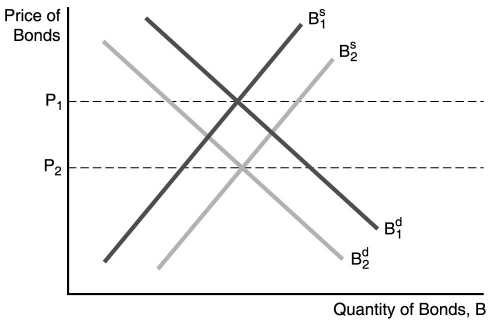

-In the figure above, the price of bonds would fall from P1 to P2 if ________.

A) inflation is expected to increase in the future

B) interest rates are expected to fall in the future

C) the expected return on bonds relative to other assets is expected to increase in the future

D) the riskiness of bonds falls relative to other assets

Correct Answer:

Verified

Correct Answer:

Verified

Q1: _ in the money supply creates excess

Q13: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5043/.jpg" alt=" -In the figure

Q28: You would be less willing to purchase

Q32: A limitation of the CAPM is the

Q33: Everything else held constant,if the expected return

Q62: Of the four effects on interest rates

Q73: A decline in the expected inflation rate

Q86: The demand for gold increases,other things equal,when<br>A)the

Q135: An increase in the interest rate<br>A)increases the

Q164: Everything else held constant,when bonds become less