Multiple Choice

Use the following to answer questions .

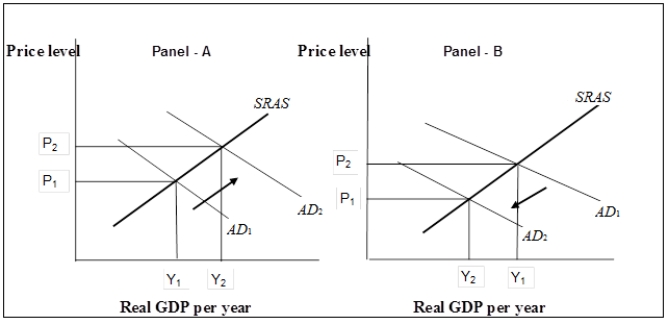

Exhibit: The Money Supply and Aggregate Demand

-(Exhibit The Money Supply and Aggregate Demand) If the economy is experiencing a recessionary gap, the Fed would

A) sell government bonds, which would decrease the money supply and increase interest rates. The results of such a policy are represented in Panel (b) .

B) buy government bonds, which would decrease the money supply and decrease interest rates. The results of such a policy are represented in Panel (a) .

C) buy government bonds, which would increase the money supply and decrease interest rates. The results of such a policy are represented in Panel (a) .

D) sell government bonds, which would increase the money supply and decrease interest rates. The results of such a policy are represented in Panel (a) .

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Which of the following statements is true?<br>A)

Q12: The Fed could conduct an open market

Q13: A decrease in the supply of money

Q14: All else constant, an increase in the

Q15: The demand curve for money shows the

Q17: What happens in the money market when

Q18: Use the following to answer questions .<br>Exhibit:

Q19: Use the following to answer questions .<br>Exhibit:

Q20: Which of the following are reasons that

Q21: At higher interest rates, people will hold