Multiple Choice

Use the following to answer questions .

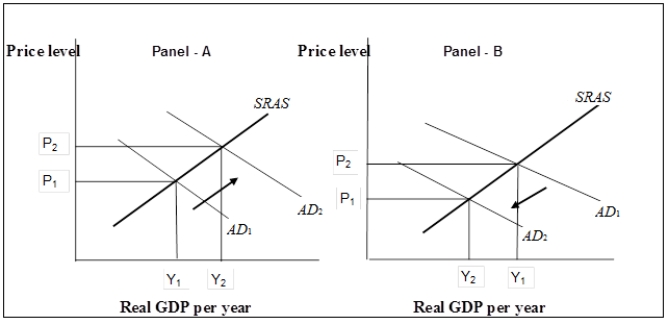

Exhibit: The Money Supply and Aggregate Demand

-(Exhibit: The Money Supply and Aggregate Demand) If the economy is experiencing an inflationary gap, the Fed would

A) buy government bonds, which would increase the money supply and decrease interest rates. The results of such a policy are represented in Panel (a) .

B) sell government bonds, which would decrease the money supply and increase interest rates. The results of such a policy are represented in Panel (b) .

C) buy government bonds, which would decrease the money supply and increase interest rates. The results of such a policy are represented in Panel (b) .

D) sell government bonds, which would increase the money supply and increase interest rates. The results of such a policy are represented in Panel (b) .

Correct Answer:

Verified

Correct Answer:

Verified

Q33: An increase in the supply of money

Q34: An increase in the demand for bonds

Q35: A bond is<br>A) a debt instrument, that

Q36: Which of the following events is likely

Q37: Suppose the Fed conducts an open market

Q39: The demand for money curve shows<br>A) the

Q40: Use the following to answer questions .<br>Exhibit:

Q41: Use the following to answer questions .<br>Exhibit:

Q42: Suppose the United States experiences a rise

Q43: Use the following to answer questions .<br>Exhibit: