Multiple Choice

Use the following to answer questions .

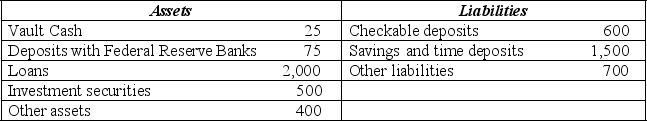

Exhibit: Balance Sheet of the Alpha-Beta Bank

-(Exhibit: Balance Sheet of the Alpha-Beta Bank) If the required reserve ratio is 10% and the market interest rate is 6%, then the opportunity cost of holding excess reserves is

A) zero since Alpha-Beta does not hold any excess reserves.

B) $0.9 million.

C) $2.4 million.

D) $4 million.

Correct Answer:

Verified

Correct Answer:

Verified

Q128: Which of the following is included in

Q129: The banking system is able to make

Q130: The deposit multiplier is the inverse of<br>A)

Q131: The Fed's most important and most frequently

Q132: The Fed seldom uses the reserve requirement

Q134: If the Fed raises its target for

Q135: Explain the differences between the two money

Q136: Suppose a bank has $50,000 in deposits

Q137: In the federal penitentiary at Lompoc, California,

Q138: An institution that collects funds from lenders