Essay

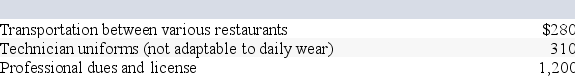

Colby is employed full time as a food technician for a local restaurant chain.This year he has incurred the following expenses associated with his employment:

Colby was reimbursed $125 of the expenses from his employer's accountable plan.How much of the expenses are deductible by Colby?

Colby was reimbursed $125 of the expenses from his employer's accountable plan.How much of the expenses are deductible by Colby?

Correct Answer:

Verified

$0.

Unreimbursed emp...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Unreimbursed emp...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q41: Larry recorded the following donations this year:

Q53: Which of the following is a true

Q54: Which of the following is a true

Q55: Don's personal auto was damaged in a

Q57: Taxpayers filing single and taxpayers filing married

Q59: The deduction for investment interest in excess

Q61: Misti purchased a residence this year.Misti, age

Q62: Detmer is a successful doctor who earned

Q72: Carly donated inventory (ordinary income property)to a

Q93: Deductible medical expenses include payments to medical