Essay

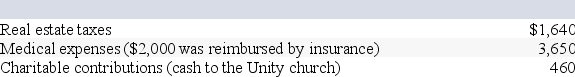

Bryan is 67 years old and lives alone.This year he has received $25,000 in taxable interest and pension payments, and he has paid the following expenses: Use Standard deduction.

If Bryan files single, calculate his taxable income.

If Bryan files single, calculate his taxable income.

Correct Answer:

Verified

$11,150 = $25,000 − $13,850.

Bryan's ite...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Bryan's ite...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q45: Ned is a head of household with

Q46: Which of the following is a deductible

Q47: Andres and Lakeisha are married and file

Q48: Taxpayers are allowed to deduct mortgage interest

Q51: Jon and Holly are married and live

Q52: Which of the following costs is deductible

Q53: Which of the following is a true

Q54: Which of the following is a true

Q78: Taxpayers traveling for the primary purpose of

Q98: Taxpayers may elect to deduct state and