Essay

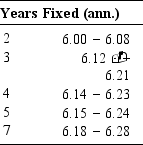

A swap dealer provides the following quotations for a yen/$ currency swap. The quotes are for a yen fixed rate against the U.S. Treasury yield flat, with annual payments.

A client wishes to enter a five-year swap, paying yen and receiving $. The current yield on five-year U.S. Treasury bonds is 7.20%, using the semiannual method, which amounts to 7.33%, using the annual European method.

A client wishes to enter a five-year swap, paying yen and receiving $. The current yield on five-year U.S. Treasury bonds is 7.20%, using the semiannual method, which amounts to 7.33%, using the annual European method.

What will the exact terms of the swap be if the client accepts these quotations?

Correct Answer:

Verified

As stated in the table, the swap quotes ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: Digital options: Digital (or binary) options

Q17: An American investor wants to invest in

Q18: You specialize in arbitrage between the futures

Q19: Assume that an AAA customer pays 8%

Q20: The current dollar yield curve on

Q22: A dollar-Swiss franc swap with a maturity

Q23: A money manager holds $50 million worth

Q24: A Swiss portfolio manager has a significant

Q25: A five-year currency swap involves two AAA

Q26: A small German bank has the