Essay

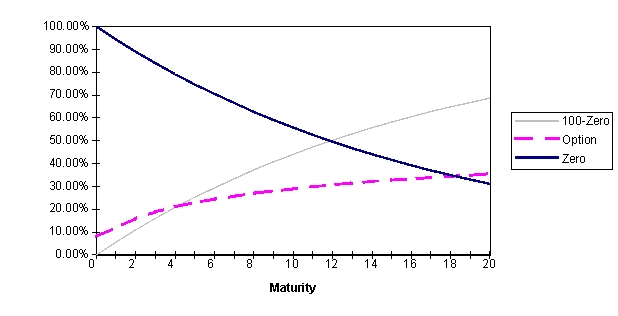

You're a banker. A client wishes to buy a guaranteed note with a 100% indexation to the stock index's growth. In other words, he doesn't want any coupon but requires 100% of the index growth. You wonder about the maturity of such a note. You check the prices of various index calls traded on the market for different maturities. Their strike is the current index level and their price is expressed as a percentage of this level. (For instance if the CAC is worth 3,000, the strike is 3,000 and the one-year maturity call trades at 11% of 3,000. You also check the price of a zero-coupon in percentage for various maturities. The following graph shows, for each maturity, the price of the option, that of the zero-coupon, and 100%-zero.  a. What is the maturity of the guaranteed note (coupon =0%, indexation =100%)? Justify.

a. What is the maturity of the guaranteed note (coupon =0%, indexation =100%)? Justify.

b. If as a banker, you want to make a profit, should you lengthen or shorten the maturity of that note? Explain why.

c. Everything remaining constant (that is, same volatility and interest rate), should the maturity of the guaranteed note be shorter or longer if the index pays a low dividend rather than a high one? Why?

Correct Answer:

Verified

a. We must take the intersection between...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: A differential swap, or switch LIBOR swap,

Q3: You are a young investment banker considering

Q4: A manager holds a diversified portfolio

Q5: In 1990, the French bank, BNP, issued

Q6: You are currently borrowing €10 million at

Q8: The current yield curve on the

Q9: If the average premium on gold call

Q10: A small French bank has the

Q11: Strumpf Ltd. decides to issue a convertible

Q12: You wish to establish the theoretical