Essay

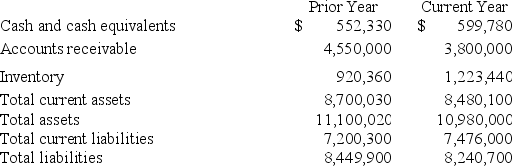

The financial information below presents selected information from the financial statements of Pelican Company.Sales revenue during the current year was $13,700,300 and cost of goods sold was $8,905,195.All of Pelican's sales are made on account and are due within 30 days.

Required:

Required:

Part a.Current ratios as of the end of the current and prior year.

Part b.Calculate the receivables turnover ratio for the current year.

Part c.Calculate the days to collect for the current year.

Part d.Calculate the inventory turnover ratio for the current year.

Part d.Calculate the days to sell for the current year.

Part e.Evaluate the company's liquidity position at the end of the current year.Cite any additional information not given in the problem that would be helpful in evaluating the company's liquidity.

Round all ratios to two decimal places.

Correct Answer:

Verified

Part a

Current ratio = Current assets ÷ ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Current ratio = Current assets ÷ ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: If an analyst wanted to assess a

Q28: A decrease in receivables turnover ratio is

Q40: A current ratio of less than one

Q44: Liquidity measures the ability of a company

Q47: In a common size income statement,each item

Q55: Vertical analysis:<br>A)identifies the relative contribution made by

Q104: A debt-to-assets ratio of 0.50 indicates that

Q115: The comparative financial statements of Seward,Inc.include the

Q149: Which of the following measures would assist

Q182: Which type of analysis could reveal that