Essay

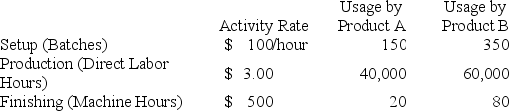

Harwell,Inc.produces two different products,Product A and Product B.Harwell uses a traditional volume-based costing system in which direct labor hours are the allocation base.Harwell is considering switching to an ABC system by splitting its manufacturing overhead cost of $400,000 across three activities: Setup,Production,and Finishing.Under the traditional volume-based costing system,the predetermined overhead rate is $4.00/direct labor hour.Under the ABC system,the rate for each activity and usage of the activity drivers are as follows:

Required:

Required:

a.Calculate the indirect manufacturing costs assigned to Product A under the traditional costing system.

b.Calculate the indirect manufacturing costs assigned to Product B under the traditional costing system.

c.Calculate the indirect manufacturing costs assigned to Product A under the ABC system.

d.Calculate the indirect manufacturing costs assigned to Product B under the ABC system.

e.Which product is under-costed and which is over-costed under the volume-based cost system compared to ABC?

Correct Answer:

Verified

a.$160,000 = $4.00 × 40,000

b.$240,000 =...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b.$240,000 =...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: Jackson,Inc.produces two different products (Product 5 and

Q21: Prevention costs are incurred to prevent quality

Q22: Which of the following best defines a

Q23: Which of the following is the correct

Q24: Cricket Company has identified seven activities as

Q26: Magenta Company has identified seven activities as

Q27: Garfield Personal Training Services is owned by

Q28: Which type of quality cost would a

Q29: Yallow,Inc.manufactures teddy bears and dolls.Currently,Yallow makes 2,000

Q30: Calverton,Inc.produces two different products (Standard and Luxury)using