Essay

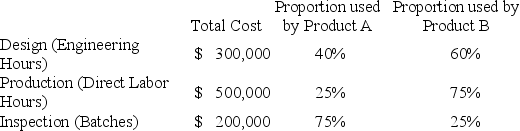

Carter,Inc.uses a traditional volume-based costing system in which direct labor hours are the allocation base.Carter produces two different products: Product A,which uses 100,000 direct labor hours,and Product B,which uses 300,000 direct labor hours.Carter is considering switching to an ABC system by splitting its manufacturing overhead cost of $1,000,000 across three activities: Design,Production,and Inspection.Under the traditional volume-based costing system,the predetermined overhead rate is $2.50/direct labor hour.Under the ABC system,the cost of each activity and proportion of the activity drivers used by each product are as follows:

Required:

Required:

a.Calculate the indirect manufacturing costs assigned to Product A under the traditional costing system.

b.Calculate the indirect manufacturing costs assigned to Product B under the traditional costing system.

c.Calculate the indirect manufacturing costs assigned to Product A under the ABC system.

d.Calculate the indirect manufacturing costs assigned to Product B under the ABC system.

e.Which product is under-costed and which is over-costed under the volume-based cost system compared to ABC?

Correct Answer:

Verified

a.$250,000 = $2.50 × 100,000

b.$750,000 ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b.$750,000 ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: The purpose of Stage 1 allocations is

Q13: Which of the following best defines a

Q14: Pima,Inc.manufactures calculators that sell for $40 each.Each

Q15: When forming activity cost pools,the goal is

Q16: Pima,Inc.manufactures calculators that sell for $40 each.Each

Q18: Hayden,Inc.produces two different products,Product A and Product

Q19: Jefferson,Inc.produces two different products (Product 5 and

Q20: Jackson,Inc.produces two different products (Product 5 and

Q21: Prevention costs are incurred to prevent quality

Q22: Which of the following best defines a