Essay

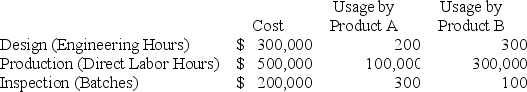

Carter,Inc.produces two different products,Product A and Product B.Carter uses a traditional volume-based costing system in which direct labor hours are the allocation base.Carter is considering switching to an ABC system by splitting its manufacturing overhead cost across three activities: Design,Production,and Inspection.The cost of each activity and usage of the activity drivers are as follows:

Carter manufactures 10,000 units of Product A and 7,500 units of Product B per month.

Carter manufactures 10,000 units of Product A and 7,500 units of Product B per month.

Required:

a.Calculate the predetermined overhead rate under the traditional costing system.

b.Calculate the activity rate for Design.

c.Calculate the activity rate for Machining.

d.Calculate the activity rate for Inspection.

e.Calculate the indirect manufacturing costs assigned to each unit of Product A under the traditional costing system.

f.Calculate the indirect manufacturing costs assigned to each unit of Product B under the traditional costing system.

g.Calculate the indirect manufacturing costs assigned to each unit of Product A under the ABC system.

h.Calculate the indirect manufacturing costs assigned to each unit of Product B under the ABC system.

i.Which product is under-costed and which is over-costed under the volume-based cost system compared to ABC?

Correct Answer:

Verified

a.$2.50 = ($300,000 + $500,000 + $200,00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q31: The first step in ABC is:<br>A)to calculate

Q32: The gross margin does not take into

Q33: Lincoln,Inc. ,which uses a volume-based cost system,produces

Q34: Prevention costs are costs that:<br>A)are incurred to

Q35: Cottonwood,Inc.produces two different products (Standard and Luxury)using

Q37: Magnolia Company has identified seven activities as

Q38: Activity Based Costing divides activities into two

Q39: Activity-based costing systems include non-volume-based cost drivers.

Q40: Jefferson,Inc.produces two different products (Product 5 and

Q41: Each individual indirect cost should be assigned