Essay

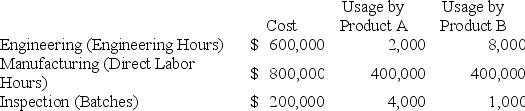

Hayden,Inc.produces two different products,Product A and Product B.Hayden uses a traditional volume-based costing system in which direct labor hours are the allocation base.Hayden is considering switching to an ABC system by splitting its manufacturing overhead cost across three activities: Engineering,Manufacturing,and Inspection.The cost of each activity and usage of the activity drivers are as follows:

Hayden manufactures 10,000 units of Product A and 5,000 units of Product B per month.

Hayden manufactures 10,000 units of Product A and 5,000 units of Product B per month.

Required:

a.Calculate the predetermined overhead rate under the traditional costing system.

b.Calculate the activity rate for Engineering.

c.Calculate the activity rate for Manufacturing.

d.Calculate the activity rate for Inspection.

e.Calculate the indirect manufacturing costs assigned to each unit of Product A under the traditional costing system.

f.Calculate the indirect manufacturing costs assigned to each unit of Product B under the traditional costing system.

g.Calculate the indirect manufacturing costs assigned to each unit of Product A under the ABC system.

h.Calculate the indirect manufacturing costs assigned to each unit of Product B under the ABC system.

i.Which product is under-costed and which is over-costed under the volume-based cost system compared to ABC?

Correct Answer:

Verified

a.$2.00 = ($600,000 + $800,000 + $200,00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: When target costing is used,the target cost

Q3: How is activity-based management related to activity-based

Q4: Target costing involves determining what the product

Q5: Activity-based costing is not appropriate for service

Q6: The gross margin is calculated by subtracting

Q8: Activity-based management is a method of assigning

Q9: Sherman,Inc.manufactures chainsaws that sell for $58.Each chainsaw

Q10: When is a volume-based cost system appropriate

Q11: Fremont Systems produces two different products,Product A,which

Q12: The purpose of Stage 1 allocations is