Multiple Choice

Write a linear programming model, including the objective function and the set of constraints for the following problem. DO NOT SOLVE, but be sure to define all your variables.

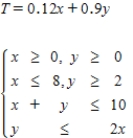

Brown Bros., Inc., is an investment company doing an analysis of the pension fund for a certain company. The fund has a maximum of $10 million to invest in two places: no more than $8 million in stocks yielding 12%, and at least $2 million in long-term bonds yielding 9%. The stock-to-bond investment ratio cannot be more than 2 to 1. How should Brown Bros. advise its client so that the investments yield the maximum yearly return?

DENOTE:

X = amount invested in stock (in millions of dollars)

Y = amount invested in bonds (in millions of dollars)

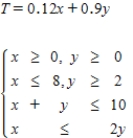

A)

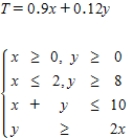

B)

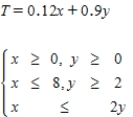

C)

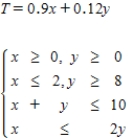

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q14: A collection of coins has a value

Q15: A plane with a tail wind makes

Q16: The Thompson Company manufactures two industrial products,

Q17: Find the matrix [A]([B] + [C]), if<br>

Q18: Find the product [ A ][ B

Q20: Solve the system by solving the corresponding

Q21: Find the corner points for the set

Q22: Solve the system for all real solutions,

Q23: Solve the system for all real solutions,

Q24: Maximize <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7816/.jpg" alt="Maximize subject