Multiple Choice

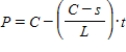

A business purchasing an item for business purposes may use straight-line depreciation to obtain a tax deduction. The formula for the present value, P, after t years is given below, where C is the cost and s is the scrap value after L years. The number L is called the useful life of the item.

If a certain piece of equipment costs $6,100 and has a scrap value of $2,300 after 5 years, graph the amount you will have in t years. What is the slope of the graph?

A)

B)

C)

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q25: Sketch the graph of the equation.

Q26: Sketch the graph of the equation.

Q27: Graph the first-degree inequality in two unknowns.

Q28: If a present value P is invested

Q29: A business purchasing an item for business

Q31: If <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7816/.jpg" alt="If ,

Q32: Sketch the curve. <br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7816/.jpg" alt="Sketch

Q33: Is the set a function?<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7816/.jpg"

Q34: State whether the statement is true or

Q35: Sketch the curve. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7816/.jpg" alt="Sketch