Short Answer

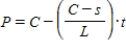

A business purchasing an item for business purposes may use straight-line depreciation to obtain a tax deduction. The formula for the present value, P, after t years is given below, where C is the cost and s is the scrap value after L years. The number L is called the useful life of the item.

If a certain piece of equipment costs $10,100 and has a scrap value of $1,700 after 8 years, graph the amount you will have in t years. What is the slope of the graph?

__________

__________

Correct Answer:

Verified

Correct Answer:

Verified

Q40: Graph the line. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7816/.jpg" alt="Graph

Q41: Find the difference quotient, <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7816/.jpg" alt="Find

Q42: Identify the curve. <br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7816/.jpg" alt="Identify

Q43: State whether the statement is true or

Q44: Let P(x) be the number of prime

Q46: State whether the statement is true or

Q47: Sketch the hyperbola with distance between the

Q48: Beams of light parallel to the axis

Q49: Graph the first-degree inequality in two unknowns.

Q50: Sketch the graph of the equation.