Multiple Choice

Exhibit 20-2

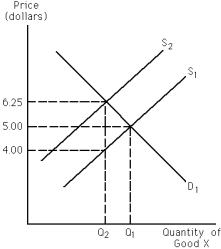

-Refer to Exhibit 20-2.The market for good X is initially in equilibrium at $5.The government then places a per-unit tax on good X,as shown by the shift of S1 to S2.As a result,

A) consumers end up paying $6.25 per unit, and producers end up receiving $5.00 per unit, but keeping only $4.00 per unit.

B) consumers end up paying $6.25 per unit, and producers end up receiving and keeping $4.00 per unit.

C) consumers end up paying $5.00 per unit, and producers end up receiving and keeping $5.00 per unit.

D) consumers end up paying $6.25 per unit, and producers end up receiving $6.25 per unit, but keeping only $4.00 per unit.

E) none of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q13: If Jack bought 18 CDs last year

Q21: If goods A and B have a

Q22: If the cross elasticity of demand for

Q25: Exhibit 20-8<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2061/.jpg" alt="Exhibit 20-8

Q26: For a straight-line,downward-sloping demand curve,price elasticity of

Q29: Exhibit 20-1<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2061/.jpg" alt="Exhibit 20-1

Q35: Exhibit 20-7<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2061/.jpg" alt="Exhibit 20-7

Q63: If for good Z income elasticity is

Q143: If the cross elasticity of demand for

Q155: If supply is perfectly inelastic, it follows