Multiple Choice

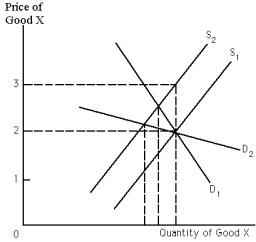

Exhibit 20-6

-Refer to Exhibit 20-6.Let S1 be the supply curve of a producer.If S2 is the supply curve of the same producer after the government imposes a per-unit tax,the share of the tax paid by the producer as compared to the share of the tax paid by consumers will be

A) greater if D1 is the demand curve facing the producer.

B) greater if D2 is the demand curve facing the producer.

C) the same regardless of which demand curve the firm faces.

D) Any of the above, depending on the type of good the tax is imposed on.

Correct Answer:

Verified

Correct Answer:

Verified

Q39: Which of the following would result in

Q117: Exhibit 20-5<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2061/.jpg" alt="Exhibit 20-5

Q118: If Cassandra bought 16 cotton blouses last

Q119: Exhibit 20-7<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2061/.jpg" alt="Exhibit 20-7

Q123: Price falls from $3 to $2,and the

Q126: Exhibit 20-3<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2061/.jpg" alt="Exhibit 20-3

Q133: If two goods are substitute goods,<br>A)an increase

Q170: Describe what cross elasticity of demand measures.

Q185: The demand curve for good X is

Q190: The percentage change in the quantity demanded