Essay

LMN Company reported the following amounts on its balance sheet at July 31,2013:

Liabilities

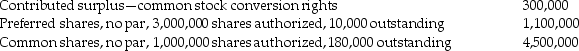

Equity

Equity

Additional information

Additional information

1. The bonds pay interest each July 31. Each $1,000 bond is convertible into 5 common shares. The bonds were originally issued to yield 10%. On July 31,2014,all the bonds were converted after the final interest payment was made. LMN uses the book value method to record bond conversions as recommended under IFRS.

2. No other share or bond transactions occurred during the year.

Requirement:

a. Prepare the journal entry to record the bond interest payment on July 31,2014.

b. Calculate the total number of common shares outstanding after the bonds' conversion on July 31,2014.

c. Prepare the journal entry to record the bond conversion.

Correct Answer:

Verified

a. Journal...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: Which of the following is an example

Q13: Which statement best describes the "proportional method"?<br>A)Under

Q18: Which statement is correct about the accounting

Q21: A company issued 95,000 preferred shares and

Q50: How would exercise of warrants,that were part

Q64: Sorrentino Corporation issued call options on 20,000

Q67: How should warrants on the company's own

Q74: Assume that MAK agrees to purchase US$500,000

Q78: McMillan Manufacturing issued 60,000 stock options to

Q81: What is a "put" option?<br>A)A contract that