Short Answer

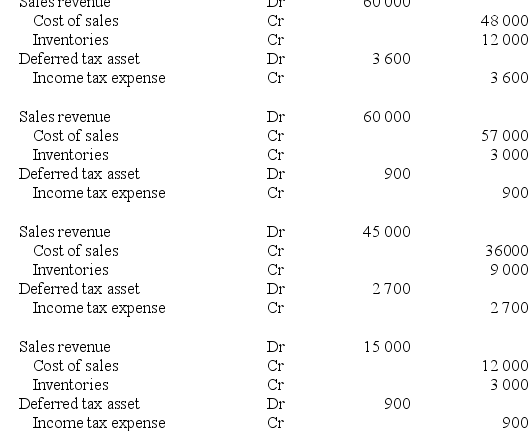

A subsidiary sold inventories to its parent for $60 000. The inventories had previously cost the subsidiary $48 000. By reporting date, the parent had sold 75% of the inventories to a party outside the group. The company tax rate is 30%. Which of the following are the adjustment entries in the consolidation worksheet at reporting date?

Correct Answer:

Verified

Correct Answer:

Verified

Q14: A subsidiary sold inventories to its parent

Q15: The effect of an intragroup sale of

Q16: When a depreciable non-current asset is sold

Q17: Chancellor Limited provided a loan of $1

Q18: A parent sold some inventories to its

Q20: A consolidation worksheet adjustment to eliminate the

Q21: A subsidiary entity sold goods to its

Q22: Unrealised profit in the opening inventories of

Q23: When an interest bearing loan is advanced

Q24: Thurston Limited sold inventories to its parent