Essay

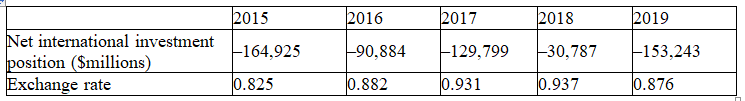

Suppose we measure Canada's net capital outflow by what Statistics Canada calls "net international investment position," and we approximate the real exchange rate of the dollar by the price of the Canadian dollar in terms of U.S. dollars. The following table gives some fictitious data on these two variables.

a. What does our open-economy macroeconomic model predict with regard to the relationship between net capital outflow and the real exchange rate?

b. Do you find evidence in the data to support the theory?

c. If you find discrepancies between the data and the theory, what could cause them?

Correct Answer:

Verified

a. Our macro model predicts an inverse r...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q148: What is the effect of an increase

Q149: Suppose that Canada places higher tariffs on

Q150: Which of the following would tend to

Q151: If the government of Pakistan made policy

Q152: If a government increases its budget deficit,

Q154: At the equilibrium interest rate in the

Q155: What does the identity "net capital outflow

Q156: What is the most likely result from

Q157: Which of the following would NOT be

Q158: In an open economy, what best identifies