Essay

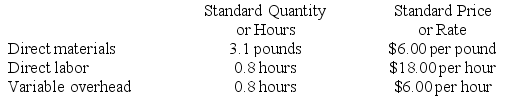

Galeazzi Corporation makes a product with the following standard costs:

In October the company produced 3,000 units using

In October the company produced 3,000 units using

8,380 pounds of the direct material and 2,610 direct labor-hours. During the month, the company purchased 9,500 pounds of the direct material at a total cost of $55,100. The actual direct labor cost for the month was $48,546 and the actual variable overhead cost was $16,965. The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

Required:

a. Compute the materials quantity variance.

b. Compute the materials price variance.

c. Compute the labor efficiency variance.

d. Compute the labor rate variance.

e. Compute the variable overhead efficiency variance.

f. Compute the variable overhead rate variance.

Correct Answer:

Verified

a. SQ = 3,000 units × 3.1 pounds per uni...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: Waste on the production line will result

Q53: Bumgardner Inc. has provided the following data

Q54: Tharaldson Corporation makes a product with the

Q55: Devoto Inc. has provided the following data

Q56: The following standards for variable manufacturing overhead

Q57: Dirickson Inc. has provided the following data

Q60: Grub Chemical Corporation has developed cost standards

Q61: The following data have been provided by

Q63: The following data for November have been

Q115: If skilled workers with high hourly rates